If compounding and payment frequencies are different, this calculator converts interest to anĮquivalent rate and calculations are performed in terms of payment frequency. Compounding The frequency or number of times per year that interest is compounded. Interest Rate The annual nominal interest rate, or stated rate of the loan.

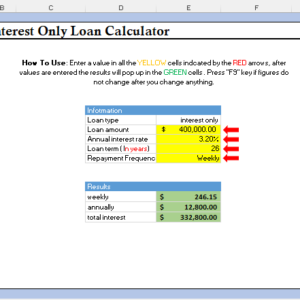

Loan Amount The original principal on a new loan or principal remaining on an existing loan. You can also use ourīasic loan calculator which assumes your loan has the typical monthly payment frequency and monthly interest compounding. Create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan.Ī key feature of this calculator is that it allows you to calculate loans with different compounding and payment frequencies. Use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency.

#Interest only loan calc free#

If you have further questions feel free to talk to us about your landlord accountancy queries by getting in touch at 08, via via our online contact form to speak to one of our specialist tax advisors.Calculate loan payments, loan amount, interest rate or number of payments. Typically they will require the rental income to cover anything from 125% to 140% of the interest payments. Most BTL lenders operate on an interest cover formula. Most lenders now require some form of deposit but the way they calculate how much they will lend is a factor of the rental income for the property and interest rates. How much is the deposit for a buy-to-let interest-only mortgage? The lender can then issue you a redemption statement, which confirms the specific amount to be repaid. In most cases, a lender will contact you at least a year prior to the end of your term to remind you of the deadline, then again at 6 months, and then once more as the closing date approaches. In this type of mortgage, interest is paid monthly and the total loan repayment is deferred until the end.

#Interest only loan calc full#

The original amount borrowed by the borrower must be repaid in full when the interest-only mortgage expires. What happens at the end of an interest-only buy-to-let mortgage?

You can discuss this in more detail with one of our specialist property accountants if you would like to find out what options are available to you. Your lending costs could be reduced as a result. This is especially true if you have had a variety of interest rates on your previous loans. You may want to consider consolidation if you already have multiple buy-to-let mortgages as it may be possible to reduce the amount paid overall by consolidating multiple debts into one property loan. Those with fixed-rate mortgage deals won’t see their rates change until their current offer expires, but those with tracked and variable rates may see their profits wiped out by their mortgage costs, which rise along with the base rate. To finance their investments, landlords typically choose interest-only Buy-to-Let mortgages because they are less expensive and are usually covered by rental income. Why are interest-only mortgages a common choice for buy-to-let properties?

0 kommentar(er)

0 kommentar(er)